Why I Don’t Listen to Financial Influencers

- sudeshna

- Feb 7, 2024

- 7 min read

Money rules!

Money definitely rules… more of it makes life easier. But that it not quite the point I am trying to make!

My problem is with the usual Money Rules that get thrown around without discretion.

Yet, most of us are clueless about what financial “rules” to avoid!

Want to listen to this as a podcast instead?

Ones - tips that not only fail to grow your wealth but might even set you back. In the realm of money some of your favorite finfluencers are divided on their opinions. Some say put all your money in real estate while others suggest a stock portfolio. Some say chop up your credit cards while others help you find great deals using credit cards!

If you have frequented a few finance blogs or YouTube channels, you have very likely come across the following advice:

Save as much as possible

Invest in the stock market

Monetise your passion

Start a business

In fact, I myself have asked you to do several of these things over the years.

Btw, if you like the video format, you can watch this blog as a video here:

Consider this: With the changing tides of the economy, understanding the landscape of bad money advice is crucial. Just like a toxic job, bad financial guidance can hinder your progress rather than propelling you forward.

Today, let's delve into the world of financial counsel floating around in the influencer space, promising a shortcut to wealth by age 25!

Retire Early on a cocktail sipping beach with millions of apparent dollars in your bank but probably looking at 65 years of retired life pursuing the passion of turning coconut water into wine… okay, maybe I’m exaggerating but you get the point!

It is NOT that simple.

Let's investigate the questionable money rules that you might want to sidestep!

Save 50 Percent of Your Income:

Save 50 percent of your income has become popular advice in the FIRE community. And even outside of the FIRE community, it has been widely distributed by media channels like CNBC and The Balance.

Sure, if your income is about 100K, then maybe.

While this may sound appealing in theory, it is simply not feasible for most people. The average salary in the UK is around £35k in 2024 and for the US around the $75k mark making saving half your income seem more like a financial acrobatics stunt than a sustainable plan.

Why you ask?

Simply put, salaries haven’t kept pace with inflation.

Let's talk about inflation.

If you have lived through 2023, it is likely that I don’t need to tell you about inflation.

But just in case you are a newbie to the personal finance world, inflation is like a sneaky price hike that happens to everything over time.

Now, think about your paycheck. Is it growing at the same speed as things are getting pricier?

For most of us, the answer is a frustrating no!

Simply put, the money you're bringing in isn't growing fast enough to keep up with the rising cost of living.

Which means your real income is actually decreasing!

And that's a problem.

It means your hard-earned cash doesn't go as far, making it tougher to cover the basics, let alone save up for the future.

Statistical data shows that in recent years, salaries haven't kept pace with inflation.

Moreover, saving such a large portion of your income can actually harm the economy, as consumption is a key driver of economic growth.

I know because I spent more than 10,000 hours mastering Economics!

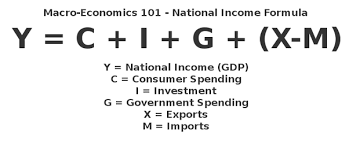

From a macroeconomic perspective, consumer spending is a crucial driver of economic activity, and the economy loses steam when individuals tighten their belts in response to stagnant wages. This creates a cycle where reduced spending leads to slower economic growth, exacerbating the problem.

For example, when you decide to treat yourself to that new pair of sneakers or invest in a snazzy blender, you're setting off a chain reaction. Your purchase isn't just money leaving your pocket; it's money entering someone else's. That someone else might use that money to buy ingredients for a restaurant, pay for a music lesson, or even hire a handyman. The cycle continues, and suddenly, that one purchase is contributing to several pockets in your community.

For the nerds, this is the core of Keynesian Economics.

It's not just about your budget; it's about the market. When people buy more, businesses need more hands on deck to keep up with the demand. Think about it: if everyone suddenly stopped buying, a lot of businesses would have to cut jobs to stay afloat. Your shopping habits ensure that your neighbors and friends remain employed.

When people are out there spending, businesses are growing, and the overall economy is booming. It's not just about buying stuff; it's about creating a healthy, thriving environment where businesses are expanding, creating more opportunities, and contributing to a better quality of life for everyone.

Of course, we want to live within our means but if everyone subscribes to the loud budgeting money rules, none of us will make much money. Whether you ask the spiritualist or the Economist in me, my answer is the same. Don’t be reckless with your money, but at the same time, don’t tie back the purse strings too tight.

Investing in Individual Stocks:

Many finfluencers promote individual stocks as the way to go for investment success. However, blindly following their recommendations can be dangerous.

Remember Gamestop?

Most of these influencers lack the necessary expertise in business analysis, and there is no assurance that their recommended stocks are suitable for every investor.

Instead, I put my money in diversified investments such as tracker funds and index funds, which provide a safer and more reliable approach to investing.

But of course you need to note that I am not a Financial Advisor, and you shouldn’t invest in tracker funds because I do. My life circumstances are likely different to yours.

However, there are odd individual stocks here and there that I invest in, but I do an in depth analysis of that stock, or know a lot about that business before I invest in it. And also I have my preferred sectors-sectors that I personally understand, sectors that I resonate with, sectors that I am a consumer of, and of which I really understand the business model.

And normally in this situation, because I have a background in business and business analysis, and I've spent years and years in financial services and studying businesses, I actually understand some of these businesses more than the average person out there. Which is why for me, sometimes these investments make sense. It's not always. A very tiny percentage of my investments lie in individual stocks.

I can’t help but remind you that you should invest in only those industries, those sectors that you understand.

Quick tip: If finance lingo is a bit murky for you, check out Money Helper in the UK for free and reliable financial advice.

Monetizing Your Passion:

Monetizing your passion is a concept that has gained significant attention lately. However, it is important to consider the practicality and profitability of your passion.

Not all passions can or should be monetized.

And even when they can be monetized, it doesn't guarantee financial success.

Let’s discuss my passion for listening to music and singing. All hell would break loose if I started singing or trying to monetize that passion of mine.

You know, I have a background in Economics and I have worked in the financial services industry for over a decade. Due to these experiences I have become an expert in the field of money. And so,

I decided to monetize my expertise.

And also because it's my expertise, it's become my passion to talk about money, to talk about earning more. And that is in fact how I have run my business over the last four, five years. That is why I run the Abundance Psyche as a brand, because I have picked up things. I have picked up my expertise about@

*How to write a great cover letter,

*How to write a great resume.

*How to crack a job interview,

*How to land yourself in consulting, or for those of you who are tired of consulting,

*How to get out of consulting.

I suggest focusing on monetizing your expertise instead, as this aligns with your knowledge and provides a more stable foundation for financial growth.

Starting a Business:

The trend of starting your own business has become increasingly popular. While entrepreneurship can be rewarding, it is not suited for everyone.

It may sound harsh, very few people will be successful in business. The reality is that only a small percentage of business ventures succeed, and the path to success often requires a unique set of skills and circumstances.

People who are that entrepreneurial are not the usual folks. They come from a very specific section of society, they come from a very specific pedigree. There's nothing to say that other people can't do it.

In fact, in recent days, we have seen a lot of people who have broken those barriers to go and build something of their own, but they have something special in them. One of which is luck and the other is perseverance.

For most people, focusing on their careers and seeking growth opportunities within their professions is a more viable and sustainable approach.

Only about 4% of the UK population earn over 100K of income annually. And I'll also tell you this- earning 100K annually, in your day job is a hundred times easier than earning that in your business. Ask anyone who is trying to bootstrap their startup.

Most people will tell you that they have struggled to raise capital. And even those who have ultimately raised capital. Most of them have disappeared because that is the nature of business.

We have this inclination for survivorship bias, which is we only get to see people who succeeded. So we talk about Elon Musk, Steve Jobs, Mark Zuckerberg, Steven Barlett, Gary Vaynerchuk.

However, the truth is that for every, one Stephen Barlett or every, one Gary Vaynerchuk or every one Mark Zuckerberg, there are probably 99 of those who couldn't make it.

So even if you do want to start a business, you would really be better off sticking to your job.

Conclusion:

In conclusion, saving 50% of your salary, investing in individual stocks, monetizing your passion, and starting a business are not the magical solutions to building wealth.

As an economist, I want you to take a more pragmatic approach to wealth creation. Diversified investments, leveraging expertise, and focusing on career growth are more reliable strategies for long-term financial success. Remember, building wealth is a journey that requires careful consideration and informed decision-making.

If you enjoyed reading this, you might enjoy our Money Quiz. with which you will automatically be signed up to receive my emails with insights into Money and Careers that I simply don’t share anywhere else.

Comments